Piraeus Bank’s market cap is now around €4bn, compared with €1bn just a year ago. CEO Christos Megalou says he is determined to do everything in his power to ensure it stays there. Anita Hawser reports.When Christos Megalou became CEO of Piraeus Bank in 2017, the nonperforming loans (NPLs) accounted for 54% of the bank’s loan book.

It was familiar territory for the former investment banker who spearheaded the restructuring and recapitalisation of Piraeus’s competitor Eurobank in 2013 following the Greek sovereign debt crisis.

“That was a big challenge,” says Mr Megalou, referring to his recapitalisation of Eurobank worth around €3bn. “But it went well. So after Eurobank I left Greece and returned in 2017, when I was offered to head up Piraeus Bank, which had NPLs somewhere in the region of €35bn. That’s a big number. And it’s only through a lot of hard team work over the past six years [that] we’ve reduced this number to €2.5bn. It’s now about 6% of our [loan] book, and by the end of the year we hope to get it down to about 4%.”

Understanding the magnitude of the problem

“Our capitalisation is now around €4bn, from €1.1bn a year ago. But deep inside I’m an investment banker [he held senior positions at Credit Suisse Investment Banking for more than 20 years in London], and I know whatever goes up, goes down as well. I try to do everything I can so that it will stay up there.”

So how did Piraeus Bank go from problem child to star pupil? Mr Megalou attributes the bank’s turnaround to a combination of factors. “We started by understanding the magnitude of the problem and how to manage it. As part of this exercise we did the first sale of NPLs in Greece using real estate as collateral. We called it Project Amoeba because it was the first time a Greek bank sold secured NPLs.”

“We sold these loans in October 2018 to Bain Capital, and it was daring enough to buy the NPLs at 30 cents on the euro. A lot of people thought that was a good price because before that UniCredit had done a much bigger transaction, which got around 12 to 15 cents on the euro.

“Ours was a much smaller transaction – €1.5bn out of €35bn – but we still managed to get 30 cents on the euro, which was important as we proved to the market there were investors out there willing to buy non-performing exposures out of Greece using real estate as collateral.”

After that landmark sale to Bain Capital, Mr Megalou says the bank saw growing interest from firms looking to manage what was, at the time, Greece’s biggest portfolio of NPLs. “We had interest from Cerberus and Intrum from Sweden. We ended up going with Intrum, which is the biggest servicer of NPLs in Europe. It bought our non-performing exposures management unit, which we carved out from the bank with 1200 people attached to it. We sold that to Intrum for €440m of equity. It’s now managing it through an entity called Intrum Hellas where we are a 20% shareholder and Intrum owns 80%.”

The €400m it raised from the sale of the NPLs management unit to Intrum gave Piraeus the opportunity to claim another first for the bank and Greece: a €400m subordinated bond sale in 2019. “At that point in time, the bank could not raise equity,” says Mr Megalou. “That was very clear for us. In February 2020, we did a second tier-two bond for €500m with a rate of 5.5%. That gave us the opportunity to start cleaning up the bank.”

Then, Piraeus Bank went on to do an equity raise worth €1.4bn in 2021. Before that, it had exited six countries in southern Europe and the Balkans. The exit plan was part of a restructuring plan agreed with the European Commission’s Competition Authorities and included the sale of Piraeus’ subsidiaries in Serbia, Romania, Albania and Bulgaria. “As part of the restructuring plan, we agreed to eliminate foreign competition because, before I joined, the bank received state aid and one of the conditions of that aid was that we were obliged to get out of competing with European banks in other jurisdictions,” explains Mr Megalou.

The year 2022 saw Piraeus Bank return to profitability. In this year’s Top 1000 World Banks, Piraeus Financial Holdings actually topped the table of the biggest movers from loss to profit. “In 2023, we’re running at something north of 12% return of tangible book value” says Mr Megalou. “All this is anchored on a very efficient and effective retail network and a solid deposit-gathering machine. Right now, we have about €58bn of deposits, which is one of the highest numbers ever for the bank.”

Original Story: The Banker | Anita Hawser

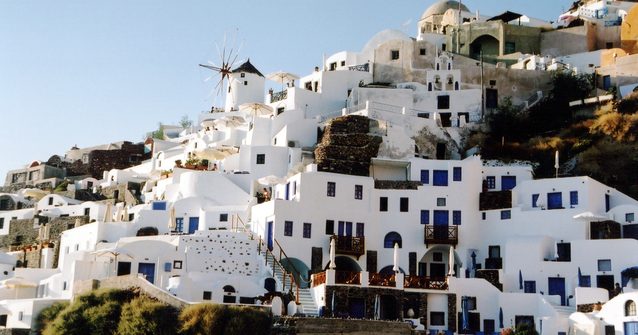

Photo: Piraeus Bank website

Edition: Prime Yield